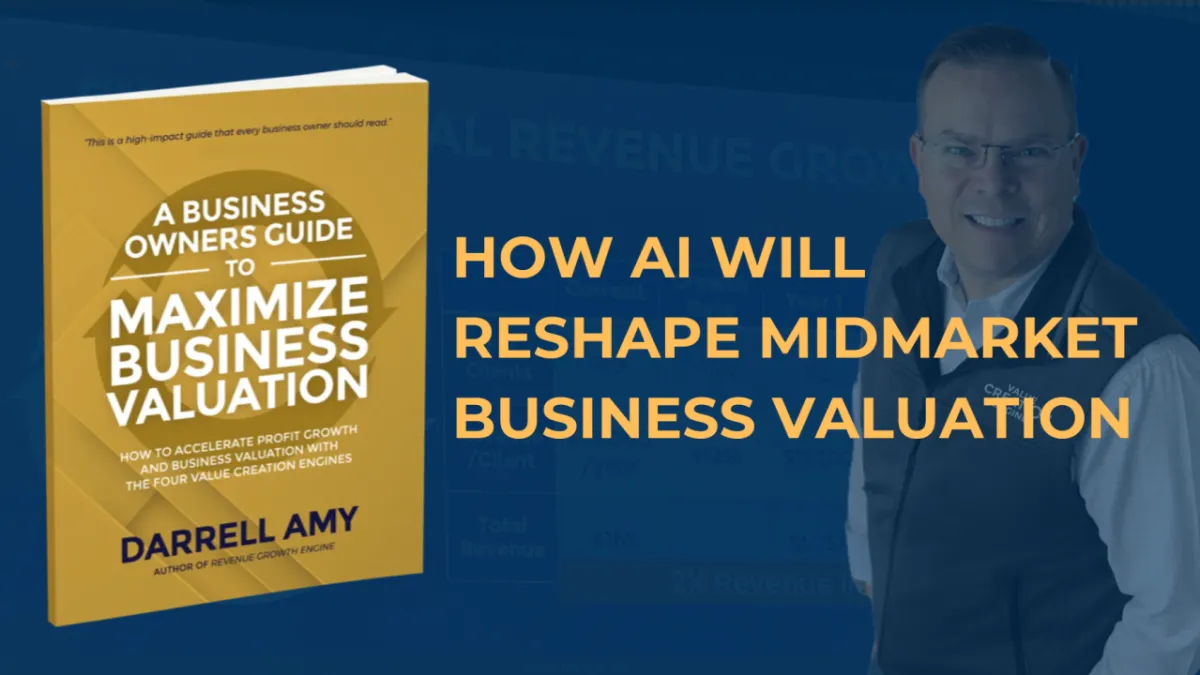

How AI Will Reshape Midmarket Business Valuation—Will Your Company Keep Up or Fall Behind?

In the summer of 1993, I had just graduated with my business degree and was preparing to start my career in technology sales. One Saturday afternoon, I went to Office Depot and purchased a 14.4 baud modem for the Macintosh computer I had used to write my college papers. I had no idea how much everything was about to change.

After fumbling through the settings to connect the modem to the computer and a phone line, I pressed the dial button and heard the sound that would redefine history. I was connected to the internet.

Shortly after that, Netscape made the internet browser mainstream. Over the next decade, business would be permanently changed.

Within a few years, I was building websites using Microsoft FrontPage and then Dreamweaver. The machines I sold, which once only made copies, evolved into on-ramps for getting documents onto the network and distributed through email. Manual workflows became automated, improving productivity and customer service. The web browser became part of everyday business operations.

Like most businesses, this technology radically altered my career. In 2004, I launched a business teaching hardware salespeople how to sell workflow automation software. After leading sales training, my first client asked if I built websites. Over the next 15 years, I built a company helping clients digitize their marketing strategy. All of this led to my first book, Revenue Growth Engine.

The Internet's Impact on Mid-Market Business Valuation

The internet revolution of the 1990s and early 2000s had a profound effect on business valuations, particularly among mid-market companies:

Increased Valuations for Early Adopters: Mid-market companies that embraced internet technologies often saw significant boosts in their valuations. Businesses that integrated digital tools for customer acquisition, e-commerce, and automation gained competitive advantages, leading to higher revenue and profitability multiples.

Decline for Non-Adopters: Conversely, mid-market businesses that failed to integrate internet technologies faced declining valuations. Traditional retailers, manufacturing firms, and service providers that resisted digital transformation saw reduced market share and struggled to attract investors or buyers. Many were acquired at discounted valuations by more tech-savvy competitors.

These examples illustrate that mid-market businesses unwilling or unable to adapt to technological advancements often suffered reduced valuations or were acquired at discounted prices by more innovative competitors.

30 Years Later: From the Internet to Artificial Intelligence

Now, 30 years after 1993, we stand at the forefront of a new technological revolution. Similar to how I connected my computer to the internet in 1993, in January of 2023, I set up my account on ChatGPT. Once again, everything was about to change.

This time, however, the transformation felt even faster. While companies took 15 years to fully adapt to the internet, the pace of change in the AI era is significantly more rapid.

How AI Will Affect Business Valuation

AI is now accelerating change at an unprecedented rate.

Just as businesses that embraced the internet gained valuation advantages, companies that strategically integrate AI will gain a pricing and profitability advantage over those that hesitate.

I believe AI will influence business valuation in the following ways:

1. Profitability and Pricing Advantage

Companies that use AI-driven automation to reduce costs, optimize operations, and enhance customer experience will increase their profit margins, leading to higher valuation multiples. AI will reshape entire industries by improving efficiency and creating new profit expectations.

"The value of your business is dependent on both the quantity and the quality of the profits your business generates." — A Business Owner’s Guide to Maximize Business Valuation

2. Agents Will Replace Software and Apps

Rather than using multiple apps and software, businesses will turn to AI agents—intelligent assistants that handle tasks, make decisions, and even automate workflows. This shift will reduce operational complexity and improve scalability, making businesses more attractive to investors.

3. Revenue per Employee Becomes the Key Metric

AI will redefine workforce productivity. Instead of measuring success by the number of employees, businesses will focus on how much revenue is generated per employee. AI-empowered businesses will operate leaner, increasing valuation by driving higher efficiency per worker.

4. Companies Will Be More Transferable

Buyers will be less concerned about key employees leaving because AI-driven systems will ensure continuity. AI can capture institutional knowledge, automate decision-making, and streamline operations, making businesses less dependent on specific individuals. This reduces perceived risk for buyers, increasing business attractiveness and valuation.

Smart companies will get ahead of this trend and integrate AI into their operations before selling. Others will sell at a discount to competitors or private equity firms that will then increase the value of their acquisition by implementing AI.

What You Should Do Now

Business owners should take proactive steps to integrate AI into their value creation strategy:

Integrate AI into your Value Creation Plan: AI should be a core component of your long-term strategy, aligning with your business goals to drive growth and efficiency.

Start Making Small Bets with AI: Establish a Process Optimization Team or a Strategic Innovation Team to explore AI use cases.

Document All Core Processes: As you document your core processes, begin to consider what parts could be improved with AI.

Clean Up Your Customer and Prospect Data: AI-driven personalization relies on high-quality data. Eventually, this data will need to be securely integrated with your AI engines.

Invest in Education: Ensure that employees understand how to leverage AI for business growth.

Develop Guardrail Policies: Define ethical AI usage guidelines to mitigate risks and compliance concerns.

Conclusion

Understanding the value of your business is the first step toward future-proofing your success. The next step is to develop a Value Creation Plan that integrates AI, ensuring that your business remains competitive, efficient, and attractive to potential buyers.

To maximize your business valuation and ensure a sustainable competitive advantage, start by assessing your business’s current worth and building a roadmap that incorporates AI-driven efficiencies. The future belongs to those who innovate and take action today.

Just as businesses that embraced the internet in the 1990s gained a competitive edge, companies that strategically adopt AI today will maximize their valuation. AI is not a passing trend—it is a foundational shift that will define the value of your business.

The question business owners should ask themselves is: Are we going to lead this change, or will we be left behind?

To maximize your business valuation and ensure a sustainable competitive advantage, start leveraging AI today. The future belongs to those who innovate.

Originally published on Darrell Amy's LinkedIn.